Boston’s baseball field. Las Vegas’s ice rink. Detroit’s Grand Prix.

Over the past six years following Siemens Realize Live, every other year, a championship team has emerged from the very city that hosted the event.

Was it just a coincidence—or was it by design?

For years, Siemens has been building ways to predict and adapt to complex realities through digital twins and AI.

This article explores how Siemens, its partners, and CEO Tony Hemmelgarn are reshaping industries and ways of thinking—creating the power to design for victory.

By Sangmin Han_han@autoelectronics.co.kr

June 5, 2025 – the final day of Siemens Realize Live Americas in Detroit.

As we wrapped up our interview with Tony Hemmelgarn, CEO of Siemens Digital Industries Software, Tony and CRO Robert Jones casually asked, “So, how was Detroit for you all?”

Half-jokingly, I replied, “It was amazing to witness yet another Siemens Grand Prix win! I’ve been following Siemens for six years now, and every two years—whenever the conference moves to a new city—a championship team seems to emerge from that very place. Is Siemens’s comprehensive digital twin even integrating with sports now?”

Tony Hemmelgarn, CEO of Siemens Digital Industries Software, and Robert Jones, CRO.

But victory doesn’t just happen by chance—does it?

From the Green Monster in Boston (2018), to the ice of Las Vegas (post-COVID, 2023), and now to the street circuit beneath Detroit’s Renaissance Center (2025), each team rose to the top through invisible design and rapid adaptability.

Like engineers perfecting products through virtual models, these teams translated intention into reality—living digital twins.

Boston Red Sox, Vegas Golden Knights, Andretti Global—what do the victories of these sports teams have to do with automotive digital transformation, the SDV shift, or Siemens?

Well, perhaps I’ve been a little “indoctrinated” after years of attending Siemens Realize Live. I’ve developed the habit of connecting everything. But this isn’t about declaring Siemens the best.

What captivated me this year wasn’t corporate pride or branding, but Siemens’s new innovations and direction—their strategy for embedded AI and lifecycle intelligence, and what they call “the most comprehensive digital twin.” (Who knows—maybe Siemens really has played a behind-the-scenes role in MLB or NHL victories, too…)

Let me exaggerate for a moment. These three teams all operated with a digitalized mindset:

The Red Sox modernized a legacy system with organic retooling.

The newly formed Golden Knights built a winning architecture from day one.

Andretti claimed victory through real-time adaptability.

They weren’t just great rosters—they were organizations that controlled complexity by design.

That’s precisely what Siemens envisions: an AI-powered, comprehensive digital twin. Predict, simulate, adapt, and redesign in response to change—that’s how champions are built. In sports. In industry. In everything.

Back to the interview—I asked Tony,

“Who is Siemens’s best role model? OEMs are at a crossroads. Can they truly realize the value of a comprehensive digital twin without using something like Teamcenter (PLM)?”

Tony offered several examples:

“BYD has achieved outstanding business innovation. GM is actively using our BOM systems. Volvo’s transformation and simulation journey is another excellent case. Bombardier transitioned in aerospace.

You can piece together various tools to build a digital twin—but it’s expensive, slow, and complex.

BYD was able to develop products 25% faster and 25% cheaper by adopting our integrated solution.

That said, we’ve designed Teamcenter to work flexibly even in environments with legacy systems or competing tools. Many of our customers still realize most of the value in those conditions.”

Exactly! When Tony and Bob asked, “How was Detroit?”—I immediately connected their answers to the champions.

BYD, from its early days, co-developed core components like EV batteries and vehicle architecture with Siemens—just like the Golden Knights were engineered as a winning team from the start.

GM, much like the Red Sox, is a legacy-rich organization with decades of BOM data, structures, and supply chains. But they’ve recognized that legacy as a barrier to digital transformation. With Siemens, they are beginning to realign those systems—moving from static to dynamic BOMs, and from hardware-centric design to integrated software-driven development.

Volvo began with PLM and is now incorporating Simcenter simulations to validate E/E systems, crash safety, and thermal management virtually—and apply those insights in real time.

That’s the equivalent of Andretti updating their race strategy on the fly after suffering a damaged front wing, yet still winning the race.

So, what did Tony actually say—both during the interview and in his sessions on-site?

He outlined what challenges customers are facing, how Siemens addresses them through its portfolio, how it differentiates itself from competitors, and how this approach is fueling growth.

In summary:

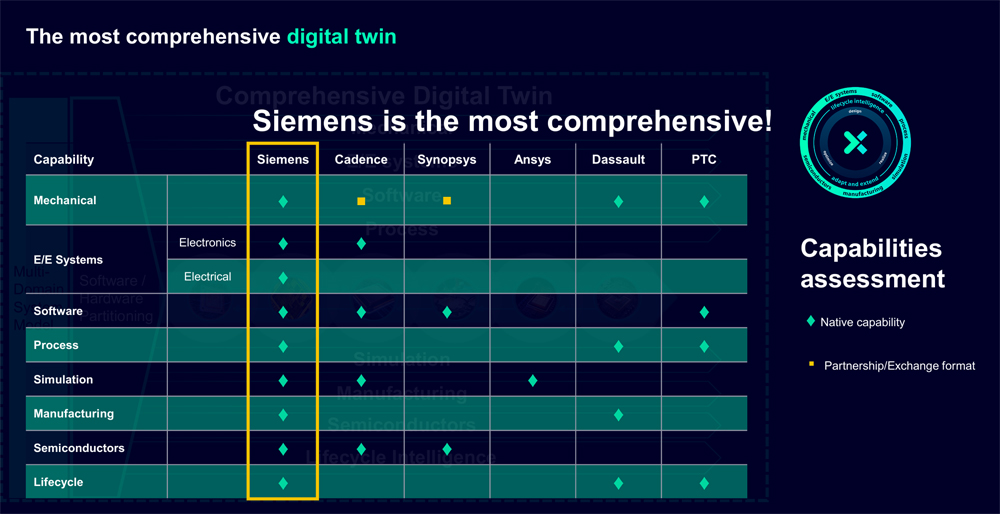

▶ Many companies talk about digital twins, but Siemens offers the most comprehensive and precise implementation. With the acquisition of Altair, Siemens’s digital twin has become even more accurate and powerful in terms of simulation and AI.

▶ Siemens has already embedded AI across its entire portfolio and built a strategy it calls Lifecycle Intelligence. This isn’t just a slogan—AI is deeply integrated into workflows, capable of understanding engineering languages and executing tasks intuitively.

▶ Most recently, this comprehensive digital twin is being tightly integrated with semiconductors and EDA—the beating heart of every modern industry.

One recurring concern Tony pointed out was the idea of the "data lake."

Many companies imagined storing enterprise data in a centralized lake and extracting innovation from it. But reality proved more difficult.

Companies often managed to gather the data—but got stuck when it came to integration and extracting meaningful insights.

“It’s very reminiscent of the early IoT craze,” Tony said.

“Back then, everyone rushed to build IoT platforms—but very few succeeded. They focused too much on the form of the platform, and never evolved it into a functioning solution.”

The same goes for PLM.

Many companies try to build their own PLM systems, like Siemens’s Teamcenter, from scratch. But maintaining and evolving them over time? That’s rare.

PLM isn’t just an R&D project—it’s long-term, complex, and demands deep integration with the broader ecosystem.

Of course, the world has changed. Hyperscalers like AWS, Microsoft, and Google now offer not only infrastructure but also functional components.

Still, that’s not enough.

Tony shared the example of a major West Coast tech company that attempted to build its own platform using such hyperscaler components—only to fail.

Getting systems to connect is one thing.

Getting them to actually work? That’s another challenge entirely.

“Don’t sell the platform first,” Tony said.

“You need to show the application. What businesses need isn’t a giant toolbox—but ready-to-use, field-tested solutions. That’s what gives customers the confidence to define their own vision.

We have to show them the art of the possible.”

In Tony’s words, the core mission is to help customers see that “art of the possible”—how to connect scattered technologies, fragmented data, and disconnected processes into one cohesive, comprehensive digital twin.

It’s not about the platform itself.

It’s about what the platform actually does—how it works in reality.

That’s what matters most.

This is where Altair comes into the picture (more on this in our interview with CTO Srikanth Mahalingam).

Through its recent acquisition of Altair, Siemens is filling strategic gaps in its portfolio—not merely expanding, but transforming structurally. With this move, Siemens gains powerful nonlinear simulation capabilities and extends its reach into electromagnetic analysis, a critical requirement for high-reliability engineering in automotive, aerospace, and semiconductors.

Altair’s RapidMiner also plays a key role as a core tool for data science.

Siemens has consistently invested in bridging the hardware-software divide.

One notable example is the acquisition of Downstream Technologies, a company known for its PCB design verification toolsets. These integrate seamlessly with Siemens’s existing Expedition-based PCB design solutions.

Such integrations are driven by customer needs—reflecting not just demand but also pressure. Siemens isn’t just delivering tools; it’s addressing some of the industry’s most persistent, systemic challenges with tangible solutions.

Siemens is also extending its reach into the EDA (Electronic Design Automation) domain.

Its recent acquisition of Exeellicon brings advanced features for SoC (System-on-Chip) design, including development, validation, and timing constraint management for IC designers. With this, Siemens is building a truly end-to-end design flow, covering everything from chip to package to system.

Another noteworthy example is Wevolver, which has now joined Siemens after close collaboration through its existing partnership with Supplyframe.

Supplyframe is a design-to-source intelligence marketplace that provides component lifecycle insights, real-time BOM cost estimation, and supplier network data directly during the design process. Together, Wevolver and Supplyframe offer data services that go beyond traditional CAD add-ons—they enable real-time optimization of design decisions.

Through these integrations, Siemens is building a collaborative digital design ecosystem, organically connecting all technologies.

Crucially, this ecosystem is designed to be inclusive—from startups to large manufacturers.

A good example is its partnership with Dotmatics, a cloud-based platform originally focused on managing and analyzing experimental data in life sciences. Dotmatics strengthens Siemens’s vision for research-driven collaboration.

At the core of this ecosystem is the concept of the Enterprise BOM (Bill of Materials).

Siemens is evolving beyond traditional PDM (Product Data Management) systems toward a structure that integrates all BOM data across the product lifecycle—with process-level coherence.

This isn’t just a list of parts.

It’s a live, integrated data platform that links design with real-time supply chains, simulation insights, and manufacturing strategies.

In essence, Siemens’s strategy is to ground the entire journey toward the digital twin in practical, actionable reality.

So, how are Siemens’s customers actually doing—especially those in the automotive industry, known for its deeply rooted legacy systems?

Volvo recently decided to fully abandon its internally developed PLM system and replaced it entirely with Siemens’s standard Teamcenter-based solution. This wasn't just a system migration—it signaled a fundamental reset of internal operations.

“When I met with Volvo again about eight months ago, they had completed the transition and were using the system very effectively,” said Tony.

“Considering what kind of customer they used to be—especially back when I managed the Ford account and Volvo was always pushing hard—it’s a really remarkable transformation.”

Much like GM, which uses a Configurator-centric approach to manage options, variants, and BOMs, this kind of transformation goes well beyond IT investment.

It’s about standardizing how a company handles complexity—creating a unified data foundation that enables designers, supply chain managers, and quality teams to make decisions based on the same source of truth.

In BYD’s case, the scope and depth of digital transformation goes even further.

The company uses Siemens’s solutions across nearly every domain—from PLM and manufacturing to software, EDA, wiring harness design, and requirements management.

And their usage is deeply integrated.

Beyond Teamcenter, BYD leverages Mendix for low-code development, Capital for harness and network design, and Polarion for ALM and requirements management.

This allows BYD to integrate every stage of development, production, and operation in real time.

For example, teams working on wiring harnesses can view and respond to the workflows of other teams in real time, with full data synchronization.

Data flows without silos, and software bridges functional gaps across departments.

As a result, BYD achieves faster decision-making and prevents errors proactively—before they manifest across the system.

“BYD develops vehicles 25% faster and at 25% lower cost than the global average,” Tony noted.

“That’s because they don’t assemble separate solutions step by step. They operate as a fully integrated system from start to finish.”

What’s even more impressive is BYD’s proactive mindset: whenever Siemens announces a new acquisition, they’re often the first to reach out and ask,

“How can we integrate this into our process?”

Tony concluded:

“We are expanding our market share—and we’re taking it directly from major competitors. Why?

Because Siemens offers the most comprehensive, end-to-end digital twin in the industry.”

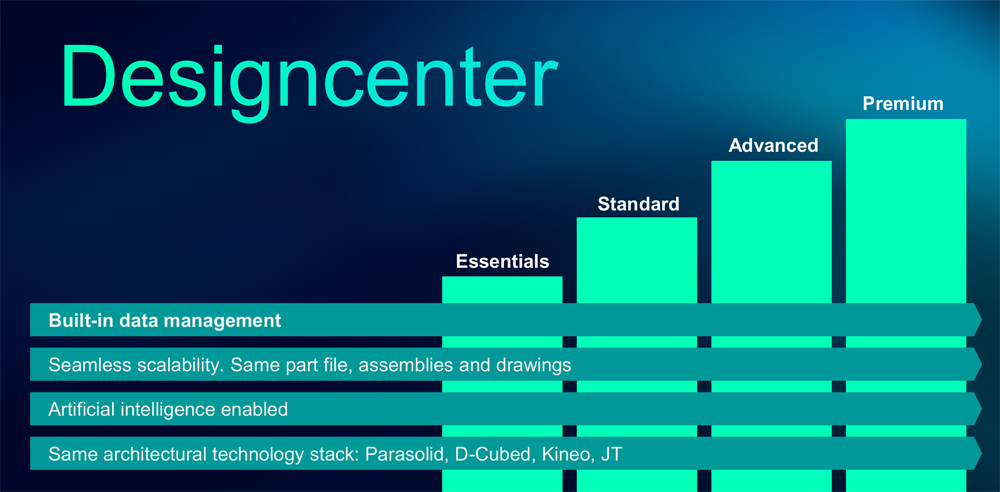

Siemens' Adaptive strategy is about enabling companies of all sizes—from startups to enterprises—to adopt and scale nearly every capability, starting with authoring tools like CAD, without structural limitations.

One of its key advantages is that it’s built on Parasolid, allowing seamless data compatibility and continuity across heterogeneous systems.

“Sure, our competitors also offer both entry-level and enterprise products,” said Tony.

“But those are based on completely different architectures. Ironically, our solutions are often more compatible with their products than their own internal offerings.

At Siemens, non-disruptive migration and upgrades between product tiers are core principles.

Recently, during a discussion with financial analysts, we showed them our SaaS adoption and transition rates, and they were stunned—saying we far outpaced our competitors.”

SaaS plays a critical role here. Siemens attributes its SaaS success to two main factors:

Scalable architecture that allows startups to grow without running into version conflicts or architectural barriers.

Domain-centric sales through channel partners—not just product push. These partners help customers uncover issues they may not even be aware of or fully understand yet, offering expert guidance and collaborative problem-solving.

A good example is the internal debate Siemens had during the development of Designcenter.

There was pushback against embedding data management features on the grounds that it contradicted the company’s “open philosophy.”

However, the decision was ultimately made to integrate Teamcenter-based data management from the Essentials to Premium tiers—recognizing that many small and mid-sized businesses need built-in data handling.

“The key,” Tony emphasized,

“is that this architecture works identically in the cloud and is fully compatible with our enterprise-grade Teamcenter.

That’s something our competitors struggle with—they may offer cloud-only solutions that don’t integrate with enterprise systems.”

So who are some of these newer, smaller customers?

VUHL Automotive, for instance, chose Siemens because of the scalable vision offered through Designcenter, which they use to build ultra-light high-performance sports cars.

Tremonia used Siemens' embedded data management to accelerate design cycles by 20% and design adjustments by 30%, significantly cutting total development time.

Siemens' broader strategy—including both major and niche acquisitions—is also creating ripples in the EDA domain.

Take Openchip, a fabless semiconductor company developing RISC-V-based high-performance computing (HPC) processors.

They joined Siemens, saying even its smaller technologies made tangible differences in their workflow.

Another notable case is Rapidus, and if we consider the extended portfolio through Altair,

Dumarey Automotive Italia adopted SimSolid to address lengthy FEM (Finite Element Method) run times.

“Dumarey’s structural design leader said that, in his view, nothing compares to SimSolid in the structural analysis space,” Tony recalled.

“Problems that used to take weeks using traditional tools are now solved in just days—with 70% improvement in time—accurately and efficiently.

That’s the kind of result that draws customers to Siemens.”

“Sometimes we face resistance in CAE,” Tony admitted,

“because people stick to the tools they first learned in university.

When that happens, I usually say:

‘The good news is—you’re familiar with your tool.

The bad news? Your competitor is moving a thousand times faster than you are.’”

Siemens’ vision for Lifecycle Intelligence and the role of AI is not just about building a massive “data lake.” Instead, it’s about how data is actually used, and what kind of backbone is needed to support that use. To illustrate this, Tony recalled his first meeting with the CEO of Dotmatics.

“When I first met the CEO of Dotmatics,” said Tony,

“he barely knew anything about Siemens’ software business.

But once I explained our strategy, and how we use AI and digital twins, he immediately said, ‘That’s exactly what we’re trying to do!’

He also added something profound: ‘Saying AI solves problems is an illusion. Without structured data, AI is just an assistant—nothing more.’”

Eventually, Dotmatics developed a model called Luma, which represents a structured, framework-based approach to data usage. The company had acquired 19 firms with strong applications widely used by scientists in life sciences.

The next step? Build APIs to connect those applications—creating a collaborative infrastructure and enabling structured data flows capable of supporting AI at the enterprise level.

According to the Dotmatics CEO, the pharmaceutical industry is 20–25 years behind other sectors when it comes to drug development.

Scientists use isolated tools, APIs are scarce, and there is virtually no system integration—while executives still expect fully coordinated results.

Siemens saw an opportunity in this inefficiency and believed it could help accelerate the digital transformation of drug development.

In Siemens’ lifecycle intelligence and AI strategy, RapidMiner plays a major role.

While RapidMiner had already seen significant development under Altair, Siemens’ vast sales network and broader market reach give it new power.

In particular, combining it with Mendix could bring significant value to customers.

“We’re already hearing the question,” said Tony.

‘If Siemens can do all of this, why would I need Snowflake or Palantir?’

People point out that while Palantir says the customer owns the data, they’re not sure that’s actually the case.

Siemens is entering this space with a clear understanding that this challenge cannot be solved with a data lake alone.

And I’m confident Siemens can take the lead in this complex, multi-layered approach.”

The combination of Siemens and Altair is creating an integrated lifecycle intelligence ecosystem—blending design, simulation, HPC, and AI analytics.

RapidMiner, for example, can be trained on datasets from manufacturing, finance, and quality assurance.

When connected to Siemens tools like Teamcenter and Mendix, it supports full-scale digital transformation across the enterprise.

Take a real-world OEM case:

In its quality assurance system, RapidMiner was connected to Teamcenter and the company’s SCM platform.

The result? It trained machine learning models on high-quality lifecycle data and was able to automatically classify quality issues with over 90% accuracy.

Altair’s SimSolid enables the analysis of complex CAD models without simplification, and FEKO’s FDTD technology, used by NASA and aerospace firms, delivers incredibly fast electromagnetic simulations.

“The combination of Siemens and Altair goes beyond just integrating technologies,” said Tony.

“It brings AI and physics-based simulation directly into real-world workflows—not as isolated tools, but as an intelligent infrastructure embedded into day-to-day operations.

That’s what we’re delivering now: not just software, but the actual intelligence our customers can act on.”

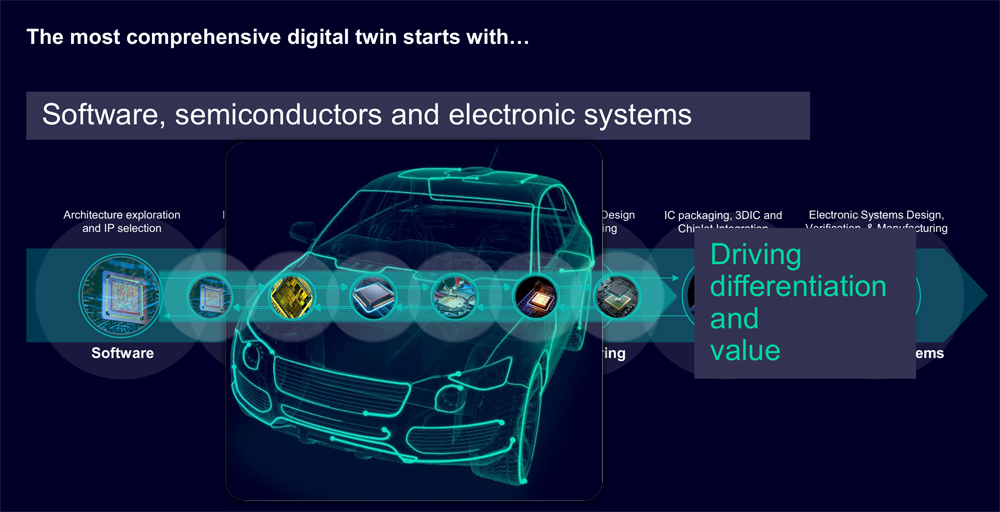

“Mercedes-Benz now calls itself a software company. Its products are designed around software, and semiconductors serve as the physical intelligence that allows that software to function.

Everything we do—and almost everything we imagine for the future—ultimately runs on semiconductors and electronic systems.

That’s why EDA (Electronic Design Automation) lies at the very core of Siemens’ digital transformation strategy.”

This closing perspective came from Mike Ellow, CEO of Siemens’ EDA business.

Mike emphasized that innovation is no longer driven by standalone products or features—it’s about designing and predicting the behavior of entire systems and ecosystems.

And true differentiation now comes from software, and the semiconductors that power it.

In Siemens’ digital twin strategy, EDA is no longer just a chip design tool.

It has become the starting point of all product development, and a key enabler of real-time monitoring and predictive capabilities even during operations.

Whether it's a vehicle, a battery pack, or an energy infrastructure system, EDA allows for holistic optimization of the entire embedded system in which the chip resides.

To support this, Siemens is deeply integrating its EDA portfolio with platforms like Teamcenter, Simcenter, and Capital.

This level of integration is particularly critical in domains that require high reliability and tight integration—such as electric vehicles, autonomous driving, and edge computing.

By connecting hardware, software, and regulatory compliance at the system level, EDA becomes a strategic infrastructure that drives speed, quality, and trust.

So what happens when EDA meets AI? And how is this actually playing out?

“It matters what kind of system the AI model runs on, and under what physical conditions,” said Mike.

“If you ignore that, AI becomes little more than a beautiful illusion.

For AI to deliver real value, it must go beyond algorithms. It must be deeply connected to the execution environment—especially semiconductor and electronic system design.”

Siemens is actively embedding AI technologies throughout its EDA portfolio.

From design optimization and power consumption forecasting to thermal modeling and automated verification, AI is already playing a central role—and all of these functions are tightly coupled with tools like Teamcenter and Simcenter.

Mike summarized it succinctly:

“We’re not just trying to finish the design faster.

We’re trying to connect the entire journey—from idea to market—within the digital twin.

EDA is no longer a quiet companion sitting next to CAD.

It is the heart of the digital twin.”

Ultimately, the core message Siemens aimed to deliver at Realize Live Americas 2025 was this:

The digital twin is a form of living intelligence—one that embraces complexity while engineering simplicity.

And the true value of this “comprehensive integration” lies not in merely connecting systems,

but in connecting real work, real ways of thinking, and the mindset required to design the future.

Whether this is just well-crafted storytelling or a truly effective strategy—that’s for customers and users to decide.

But somewhere out there, the teams already proving this future—whether in manufacturing, services, or sports teams built to win—clearly exist.

In 2018, the Boston Red Sox carried out one of the quietest rebuilds in recent memory. They didn’t dismantle their legacy system—they kept their core players intact while strategically adding only the pieces they truly needed. Manager Alex Cora didn’t rely solely on data, either. He incorporated emotional intelligence—players’ feelings, interpersonal dynamics, and overall team atmosphere—into his decisions to keep the team at its peak.

This approach mirrors Siemens’ method of applying digital twins to traditional manufacturing systems: without tearing down legacy PLM or BOM frameworks, they optimize through virtual simulation and validation. Like the Red Sox, Siemens pursues fast adaptation and calibration to build winning systems.

The rise of the Vegas Golden Knights was pure innovation. From the moment of their founding, they built a team "engineered to win from the start." Their system—composed of experienced veterans, agile leadership, and strategic recruitment—operated like a tightly integrated organizational machine.

Their ability to instantly adjust to unexpected events—such as losing a starting goalie and seamlessly inserting a backup—reflects Siemens’ philosophy of adaptive manufacturing. Siemens says: “Fail first in the virtual factory, then succeed in the real one.” The Golden Knights proved that principle in live competition.

At the 2025 Detroit Grand Prix, Kyle Kirkwood and Andretti Global exemplified the power of the real-time feedback loop. When Kirkwood’s front wing was damaged mid-race, the team instantly revised their pit strategy, adjusted the car setup, and recalibrated driving tactics on the fly.

This wasn’t a perfect pre-race simulation—it was an adaptive strategy built on a constantly updated virtual model. Siemens’ concept of AI-in-the-loop—feeding real-world data into a digital twin, generating decisions, and sending them back into the physical world—aligns closely with how Andretti Global operated.

Kirkwood’s victory wasn’t just mechanical—it was a win for intelligence that finds simplicity within complexity and reacts in real time.

AEM(오토모티브일렉트로닉스매거진)

<저작권자 © AEM. 무단전재 및 재배포 금지>